What’s the story behind your grocery bill?

Food Freedom Day is February 8, 2025

The Canadian Federation of Agriculture (CFA) has calculated that by Saturday, February 8th, 2025, a Canadian household of average income will have earned enough to pay for their entire year’s grocery bill.

Each year, CFA examines the proportion of income that Canadians spend on food to explore year-over-year expenditure changes and raise consumers’ understanding of Canada’s food system, from Farm-Gate-to-Plate.

Canadians spent 10.7% of their disposable income on food in 2024, which is lower than the 11.1% of disposable income spent on food in 2023. Due to this, Food Freedom Day falls one day before it did in 2023, which was February 9th.

With food prices having seen multiple years of significant inflation, it’s important to provide further context on the Food Freedom Day metric, as the average Canadian disposable income is not representative of every Canadian’s experience or the effects that rising food prices have on them. While Canada’s food system continues to provide access to affordable food by global standards, inflation and other global events have negatively impacted food affordability and security greatly over the past few years.

Adding onto this, recent threats of tariffs from the U.S. hold the potential to create a sharp increase in many food prices, further exacerbating the struggles with food prices that many Canadians are facing. This reality only serves to emphasize the importance of maintaining open and predictable trade across highly integrated North American agri-food supply chains.

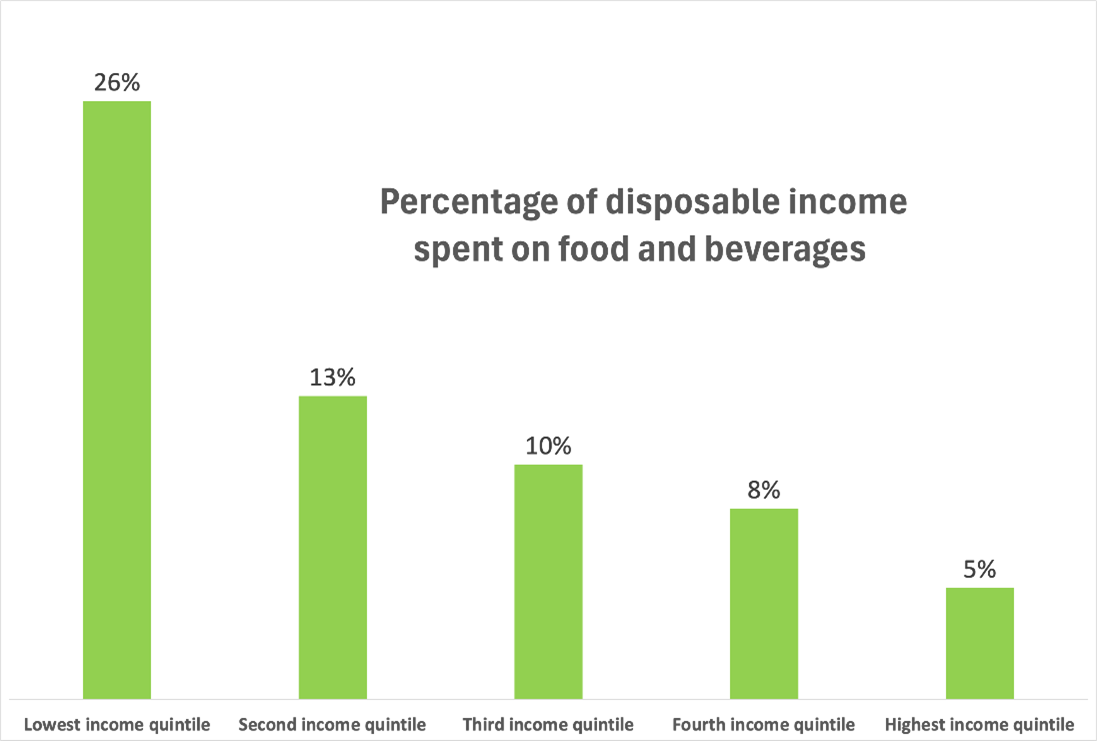

Due to this, CFA continues to analyze Food Freedom Day with an eye to the differential impact food prices have on Canadian households based on household income levels to show the percentage of disposable income that they spent on food last year. The graph below presents this information.

As can be seen in the graph above, there is a large difference between how much disposable income households in the lowest income quintile (26%) and the highest income quintile (5%) spent on food and beverages throughout the year.

CFA would like to note that while Canadians have seen food prices increase steadily throughout the past few years on the grocery shelves, farmers receive a small percentage of the price that consumers pay for food, and rising retail prices are not normally reflective of what is paid at the farm-gate.

“The Food Freedom Day metric shows that despite Canada being a trusted food supplier across the world, there is still a large group of Canadians that struggle with food affordability,” said Keith Currie CFA President.

“With the threat of tariffs hanging over our head from the U.S., these food affordability concerns only highlight the critical importance of a united Canadian approach to maintaining open and predictable North American trade. This is essential to avoid exacerbating food affordability concerns and ensuring a resilient agriculture and food industry.”