February 9, 2023 – OTTAWA – The Canadian Federation of Agriculture (CFA) has calculated that by Thursday, February 9th, 2023, a Canadian household of average income will have earned enough to pay for their entire year’s grocery bill.

Each year, CFA examines the proportion of income that Canadians spend on food as a way to explore year-over-year expenditure changes and raise consumers’ understanding of Canada’s food system, from Farm-Gate-to-Plate.

Canadians spent 11% of their disposable income on food in 2022, which is slightly higher than the 10.7% of disposable income spent on food in 2021. Due to this, Food Freedom Day is now one day later, landing on February 9th, 2023.

Food Freedom Day taking place only a day later than in 2022 will likely come as a surprise to many with the current context of rising food prices and overall inflation. While Canada’s food system continues to provide access to affordable food by global standards, inflation, global events and supply chain disruptions have led to sharp rises in price for food and other essential products, cutting into every Canadian’s disposable income.

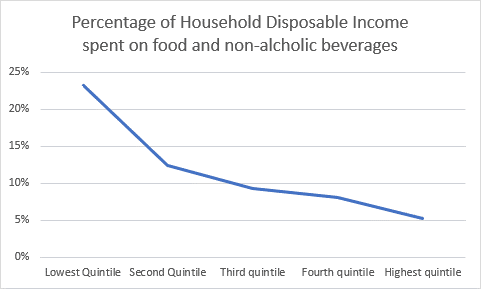

For many, the “average Canadian” that the Food Freedom Day metric describes does not portray their experiences and struggles with rising food prices. Due to this, CFA has examined this metric through the lens of the different quintiles of income of Canadian households in Canada to show the percentage of disposable income that they spent on food over the year. The graph below presents this information.

Source: Distributions of household economic accounts, income, consumption and saving, by characteristic, quarterly

As can be seen in the graph above, there is a large difference between how much disposable income households in the lowest income quintile (23.1%) and the highest income quintile (5.2%) spent on food and beverages throughout the year. Adding onto this, rising prices are affecting the lowest quintile disproportionately, with the lowest income quintile’s disposable income spending on food and non-alcoholic beverages rising faster (21.3% in 2021 to 23.1% in 2022) than the highest income quintile (5.1% in 2021 to 5.2% in 2022).

It should also be noted that food and beverage spending is fairly rigid. Those households in the highest income quintile only spent 39% more on food and beverages than the lowest income quintile, despite having over 500% more disposable income.

As can be seen, lower-income Canadian households are facing a heavier burden when it comes to rising food costs.

CFA would like to note that while Canadians have seen food prices increase steadily throughout 2022 on the grocery shelves, farmers receive a small percentage of the price that consumers pay for food, and rising retail prices are not normally reflective of what is paid at the farm-gate.

Farmers have seen their costs of production increase tremendously over the past two years, with many of their largest expenses, such as fertilizer and diesel, rising nearly 100% in that period.

“With food prices rising consistently and more quickly than overall inflation, we cannot ignore the challenges that many Canadians are facing when it comes to food affordability. While our food costs are low when compared to global standards, Canadians are seeing their disposable incomes shrink as it is taken up by the increasing costs of essential products.” Said Mary Robinson, CFA President.

“It is only through investing in resilience throughout our entire food supply chain that we can create a system less vulnerable to disruption that can provide Canadians affordable food even in the face of global supply chain disruptions.”